3 Wealth-Building Stocks, Nike’s Comeback, and the Inflation Battle Investors Can’t Ignore.

This week’s market update is a powerful mix of long-term strategy and short-term shakeups. We spotlight three blue-chip stocks with the potential to build lasting generational wealth, break down Nike’s surprising rebound amid a tough quarter, and dig into inflation data that’s keeping the Fed and investors on edge.

- Wall Street Skyrockets as Trump Teases China Trade Deal and Tariff Rollbacks. U.S. stocks hit all-time highs after Trump hinted at a breakthrough trade agreement with China, easing global tensions and reigniting investor optimism.

https://sg.finance.yahoo.com/news/stocks-climb-dollar-holds-trade-033950925.html

- Inflation Surprise: Fed’s Favorite Gauge Jumps Higher—Rate Cut Now at Risk?

Core inflation rose more than expected in May, casting doubt on a July Fed rate cut and signaling persistent price pressures despite weakening consumer spending.

- 3 Unstoppable Stocks That Could Make Your Family Rich for Generations. Amazon, Costco, and Berkshire Hathaway have unmatched advantages that could turn patient investors into multi-generational millionaires.

- AMD Is Coming for Nvidia—New AI Chip Surge and Stock Upgrade Signal Massive Upside. With soaring earnings, surging revenue, and a powerful rating upgrade, AMD is emerging as a real threat to Nvidia’s AI dominance—and investors are taking notice.

- Nike Stock Soars After Surprise Earnings Beat—Analysts Say the Worst Is Over. Despite a double-digit sales drop, Nike’s stronger-than-expected Q4 results and turnaround momentum triggered multiple analyst upgrades, hinting at a comeback investors won’t want to miss.

Feeling overwhelmed by too many stock choices and market noise? You’re not the only one with endless headlines, hot takes, and hype, it’s easy to feel stuck or second-guess your next move.

That’s where a smart investing newsletter makes all the difference. Instead of wasting time chasing tips or trying to make sense of market chatter, you’ll get straight-to-the-point insights on promising stocks, ETFs, and key trends — all in a clear, no-BS format you can use. No jargon. No fluff. Just curated ideas to help you invest smarter, faster, and with more confidence.

Stay ahead of the market, save hours of research, and grow your portfolio with clarity.

Check them out here — and start making informed moves in minutes.

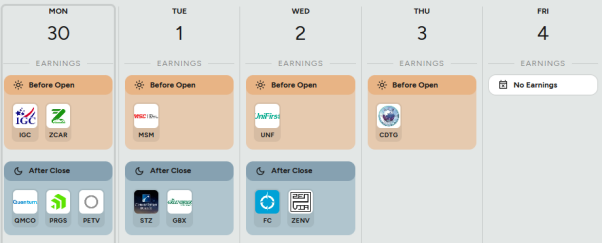

A heads-up on popular companies' earnings week from June 30 to July 4. Stay informed about when key financial updates are coming out.

Understanding the Balance Sheet: A Snapshot of Financial Health

The balance sheet is one of the 3 core financial statements (alongside income statement and cash flow) — and investors need to assess a company's financial strength and stability.

It shows a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Assets = Liabilities + Shareholders’ Equity

- Assets – What the Company Owns

- Current Assets: Cash, accounts receivable, inventory (used within a year)

- Non-Current Assets: Property, equipment, patents, long-term investments

Investor Tip: Look for strong cash positions and manageable inventory levels. High-quality assets support long-term growth. - Liabilities – What the Company Owes

- Current Liabilities: Short-term debts, accounts payable

- Long-Term Liabilities: Bonds, loans, deferred taxe

Investor Tip: High debt levels can increase risk — check Debt-to-Equity and Interest Coverage Ratios. - Shareholders’ Equity – What Belongs to Owners

- Common stock and retained earnings

- It reflects the book value of the company

Investor Tip: Consistently growing equity often signals profitable reinvestment and value creation.

Markets are navigating mixed signals: generational stocks like Amazon, Costco, and Berkshire offer long-term upside, while short-term volatility—from inflation to tariffs—keeps portfolios under pressure. In uncertain times, the best edge is clarity. Stay focused, stay informed, and keep investing with purpose.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.