5 Shockwaves Rocking the Market: From EV Wars to AI Takeovers.

From China’s EV price war shaking Tesla’s turf to AI rewriting the rules of consulting and crypto poised for a 450% breakout—this week’s biggest market moves could reshape your portfolio.

- China’s EV Price War Just Exploded — See Which Tesla Rival Is Dominating and Who’s in Trouble.

BYD slashed EV prices by up to 34%, igniting a brutal price war that’s shaking up May sales across Tesla rivals like XPeng, Nio, and Zeekr — with profits, market share, and global dominance all on the line.

- McKinsey’s AI Is Now Making PowerPoints—And It Might Replace Half of Consulting. McKinsey’s in-house AI “Lilli” is now crafting client-ready decks and reports, signaling a seismic shift in consulting where human analysts are being swapped for bots—and rivals like BCG and Bain are racing to catch up.

https://www.gurufocus.com/news/2901634/mckinseys-ai-now-writes-the-deckis-this-the-future-of-consulting

- Cathie Wood Just Went on a Buying Spree—These 3 Stocks Could Be Her Next Big Winners. With growth stocks surging back, Cathie Wood is doubling down on Amazon, AMD, and eToro—betting big on a tech-driven comeback.

- Wall Street Bank Says This Crypto Could Soar 450%—And Even Dethrone Ethereum.

Standard Chartered predicts Ripple’s XRP could skyrocket to $12.50 by 2028, fueled by ETF hype, booming stablecoin adoption, and a game-changing SEC settlement.

- Trump Doubles Steel Tariffs, China Fires Back—Markets Rattle as Trade War Tensions Explode. U.S. stock futures sink as Trump hikes steel tariffs to 50%, China accuses the U.S. of sabotaging a trade deal, and investors brace for Fed remarks and surging oil and gold prices.

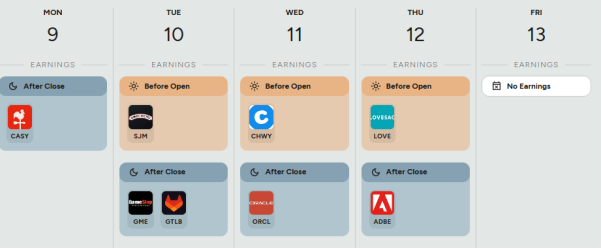

A heads-up on popular companies' earnings week from June 9 to June 13. Stay informed about when key financial updates are coming out.

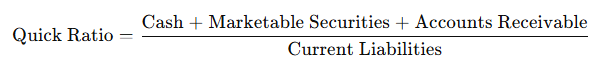

Sharpen Your Investing Skills: Quick Ratio – Liquidity Under Pressure

What Is the Quick Ratio?

Also called the Acid-Test Ratio, it’s a stricter version of the current ratio because it excludes inventory (which can take time to convert into cash).

How to Interpret It:

Quick Ratio | What It Means |

> 1.0 | Healthy – can cover short-term liabilities without relying on inventory. |

= 1.0 | Borderline – just enough liquid assets. |

< 1.0 | Potential liquidity risk – may struggle to meet near-term obligations. |

How Investors Use It:

- Risk check – Can the company survive a short-term cash crunch?

- Compare across quarters – A declining quick ratio might signal growing financial stress.

- Especially important in industries with slow-moving inventory (like heavy manufacturing).

From BYD ruthless EV pricing to McKinsey’s AI-driven future, the rules of investing are being rewritten in real time. Cathie Wood sees opportunity in chaos, crypto bulls are eyeing triple-digit gains, and trade war tremors are shaking global markets. Stay sharp, this isn’t business as usual, it’s the next era of disruption.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.