AI Chip Wars, Bitcoin’s Big Pause, and Why Even BlackRock Isn’t Safe — 5 Moves You Can’t Ignore This Week.

The market's heating up with big AI chip challengers, crypto shakeups, and one surprising Wall Street stumble.

This week, AMD and Broadcom are eyeing Nvidia’s throne, Microsoft surges on its OpenAI edge, Ethereum steals Bitcoin’s thunder, and even a giant like BlackRock takes a hit. Here's everything smart investors need to know.

- Forget Nvidia? These 2 AI Chip Stocks Could Crush It Over the Next 5 Years.

While Nvidia reigns supreme today, AMD and Broadcom are quietly gaining ground with explosive AI growth potential that could leave the GPU giant in the dust.

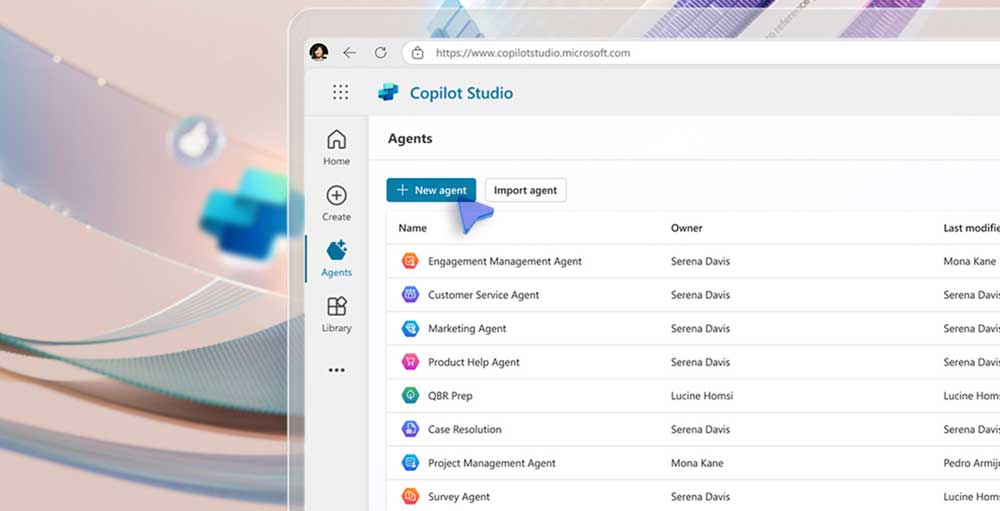

- Microsoft’s Secret Weapon? AI Partnership With OpenAI Could Make It a Multi-Trillion-Dollar Juggernaut.

A top analyst just hiked Microsoft’s price target to $595, citing its deep AI ties with OpenAI and a coming SaaS shake-up that could reshape the entire tech industry.

- Citi Crushes Expectations With Surprise Earnings Surge — Signals Stronger Year Ahead.

- Bitcoin Hits Pause After Record Surge — But Ethereum Explodes 8% on Billionaire’s Bold Bet! As Bitcoin cools off after a record-breaking run, Ethereum steals the spotlight with an 8% rally fueled by Peter Thiel’s major investment in an Ethereum-focused firm.

https://sg.finance.yahoo.com/news/bitcoin-tops-111k-brink-breaking-194849939.html

- BlackRock’s Record $12.5 Trillion Isn’t Enough to Save Its Stock — $52 Billion Exit Sends Shares Plunging. Despite hitting an all-time high and posting strong earnings, BlackRock stock tumbled nearly 6% after a surprise revenue miss tied to a massive $52 billion client withdrawal.

A heads-up on popular companies' earnings week from July 21 to July 25. Stay informed about when key financial updates are coming out.

Feeling overwhelmed by too many stock choices and market noise? You’re not the only one with endless headlines, hot takes, and hype, it’s easy to feel stuck or second-guess your next move.

That’s where a smart investing newsletter makes all the difference. Instead of wasting time chasing tips or trying to make sense of market chatter, you’ll get straight-to-the-point insights on promising stocks, ETFs, and key trends.

Stay ahead of the market, save hours of research, and grow your portfolio with clarity. Check it out here — and start making informed moves in minutes.

Sharpen Your Investing Skills: What Is an Economic Moat?

Coined by Warren Buffett, an economic moat is a lasting competitive advantage that protects a company from its rivals — just like a moat protects a castle. A company with a wide moat can defend its market share, maintain high profits, and compound growth over time.

Types of Economic Moats

- Brand Power (e.g Apple, Coca-Cola)

- Cost Advantage (e.g Walmart, Costco)

- Network Effect (e.g Facebook, Visa)

- Switching Costs (e.g Adobe, Salesforce)

- Intangible Assets (e.g Patents, Licenses)

Why Economic Moats Matter to Investors

- Companies with wide moats tend to survive downturns, outpace competition, and reward shareholders over decades.

- Moats protect margins, market share, and pricing power.

- They enable long-term compounding, the secret behind legendary investor returns.

How to Spot a Company with a Moat

- High and stable gross profit margins

- Strong return on equity (ROE) and return on invested capital (ROIC)

- Market leadership in a niche or globally

- A product or service people can’t easily replace or live without

Anyone can shine in a bull market — but only companies with strong fundamentals and durable economic moats can weather every cycle.

Every boom brings a shakeout. From AI chips and crypto to fintech disruptors, today’s headlines often hide tomorrow’s biggest winners or losers. Don’t get caught chasing hype. Instead, learn to spot real value early and stay ahead of the curve.

If your goal is to build long-term wealth, mastering business fundamentals and identifying economic moats isn’t just smart — it’s your biggest advantage.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.