AI Star or Setup for a Fall? Super Micro's Wild Ride Has Investors on Edge.

The Market’s Changing—Are You Ready to Move With It?

From the U.S. losing its AAA credit crown to AI stocks on a rollercoaster ride, this week was anything but quiet. We’re covering why some companies now outrank the government in credit, what Bitcoin’s breakout could mean for stocks, and the stealth rally of an underrated medical tech gem.

In just 10 minutes, get the headlines, red flags, and market movers you need to know—so you can invest smarter, faster. Let’s dive in!

- America Just Got Downgraded—These 2 Companies Now Have Better Credit Than the U.S. Government. As the U.S. loses its last AAA rating, Microsoft and Johnson & Johnson now outshine the government in creditworthiness—here’s what it means for your investments.

- Bitcoin Is Teasing Its All-Time High—Is a Massive Short Squeeze About to Explode Past $109K? With record-breaking futures interest and a bullish chart setup, Bitcoin’s breakout above $109K could trigger a historic rally that crushes short sellers.

- This AI Stock Just Soared 52%—But a Shocking Short Report Could Signal a Crash Ahead. Super Micro Computer’s explosive rebound has wowed investors, but razor-thin margins and a damning short-seller report could turn this AI darling into a ticking time bomb.

- This Under-the-Radar Stock Is Surging—Is It the Next Big Momentum Play Medical tech player Integer Holdings (ITGR) is flashing strong momentum signals—here’s why Zacks thinks it could be a breakout winner for savvy investors.

https://finance.yahoo.com/news/momentum-investor-1-stock-could-135010502.html

- Missed the Growth Stock Boom? Here's Why 2025 Might Be Your Last Best Chance to Catch Up. After a brutal crash and stunning rebound, growth stocks are setting up for another breakout—learn the key strategies to ride the next wave to wealth.

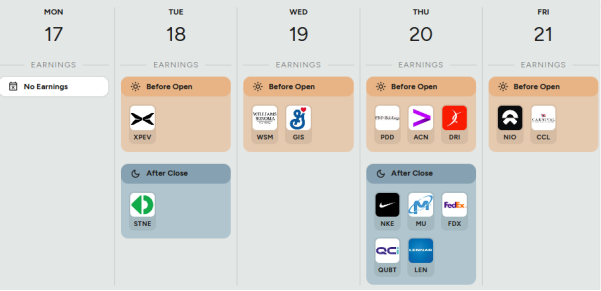

A heads-up on popular companies' earnings week from March 17 to March 21. Stay informed about when key financial updates are coming out.

Sharpen Your Investing Skills:

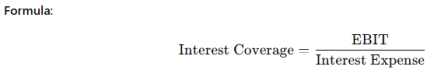

Interest Coverage Ratio – Debt Payment Ability

(EBIT = Earnings Before Interest and Taxes)

What it shows: How easily a company can pay interest on its debt.

Ratio | Meaning |

> 3 | Financially healthy. |

< 1.5 | At risk of defaulting on interest payments. |

- A key indicator for companies with significant debt.

Super Micro Computer’s meteoric rebound has grabbed headlines—but behind the surge lies a fragile foundation. With slim margins, heavyweight suppliers and customers squeezing both ends, and serious allegations resurfacing from a notorious short-seller, this isn’t just a growth story—it’s a high-wire act.

As AI hype fuels rallies, don’t let excitement cloud your judgment. Dig deeper, weigh the risks, and remember that not every breakout is built to last.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.