Buybacks, Red Flags & Big Drops: What You Need to Know Before Your Next Move

The stock market is always moving, and so are the forces shaping it. This week, we cover the hidden power of corporate buybacks, red flags to watch for, and stocks that took a big hit—are they done, or ready to bounce back?

Plus, if market swings keep you awake at night, it might be time to rethink your strategy.

Read on for critical insights that could guide your next move. Let’s dive in.

- Stock Market on the Brink? Corporate America Has a $1 Trillion Safety Net! As economic uncertainty looms, companies may ditch investments and pour up to $1 trillion into stock buybacks—creating a hidden floor for the market.

https://www.morningstar.com/news/marketwatch/2025031054/theres-a-fed-put-and-a-trump-put-but-dont-forget-the-c-suite-put-as-well

- Investors Beware! Before you buy your next stock, watch out for these warning signs—rising inventory, falling sales, and insider selling could spell trouble for your portfolio!

- Nvidia’s stock is down nearly 18% this year as fears of slowing AI demand, missed deadlines, and rising competition send shockwaves through the entire semiconductor industry.

https://finance.yahoo.com/news/nvidia-leads-chipmaker-stocks-lower-as-investor-fears-over-ai-demand-continue-to-weigh-151656986.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAD-Yeq3uMtmmYYe_dKf2hv918n3vHitEFl0iIX9Szo9TFPAr_mSYZrjo2lhjWFYNBcUTsm-c6k-2z2tOd3ZEATe8S5gIzLKZlWJ-wz5QdHW_KhkCrxdVWWkdHjxnk7Fqd6hzHcdwPTVx5DVjSUGPNoiDVdoWl3PZc7wvH-PfL648

- This AI Stock Just Crashed 23%—But It Could Be a Massive Comeback Play! Despite a sharp drop, Marvell Technology’s AI-driven growth is surging—here’s why this beaten-down stock could be a bargain before it rebounds!

- The Stock Market Feels Like a Roller Coaster—Here’s How to Stay on Track! Investing is emotional, but managing risk and knowing your tolerance can keep you from making costly mistakes—here’s how to take control of your financial future!

Sharpen Your Investing Skills: Exponential Moving Average (EMA)

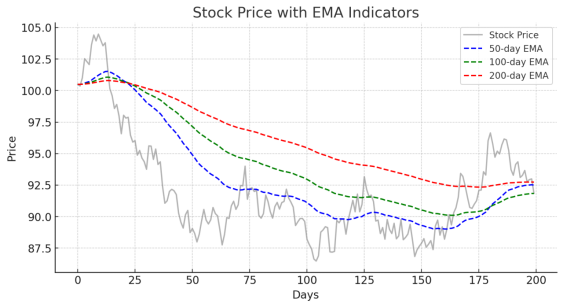

The Exponential Moving Average (EMA) is a key tool in technical analysis that helps investors identify trends and make informed trading decisions. Unlike other moving averages, the EMA gives more weight to recent prices, making it more responsive to price changes.

Why is EMA Important?

● Identifies Trends – Helps investors see whether a stock is in an uptrend or downtrend.

● Finds Entry & Exit Points – Traders use EMA crossovers to decide when to buy or sell.

● Acts as Support & Resistance – The EMA often serves as a dynamic price barrier.

EMAs Used by Investors

1. 50-day EMA – Commonly used to identify medium-term trends.

2. 100-day EMA – Helps confirm long-term trends.

3. 200-day EMA – A key indicator for overall market direction.

EMA in Action

Below is a graph showing how the EMA follows stock prices and reacts to market changes.

That’s all for this week. The market is full of opportunities, but also risks. Staying aware of the signs, managing your emotions, and sticking to your strategy will help you make smarter decisions.

Remember, the key to success is knowing when to act—and when to stay patient.

Happy investing, and stay sharp!

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your due diligence before making any investment decisions.