CrowdStrike Partners With Nvidia & Amazon — Is This the Ultimate AI Security Stock?

CrowdStrike (CRWD) has surged nearly 21% this year, crushing the cybersecurity industry and peers like Palo Alto Networks and SentinelOne. With its AI-native Falcon platform, booming subscription growth, and powerful partnerships with Nvidia, Amazon, and Zscaler, the company is cementing its leadership in next-gen cybersecurity. But after such a strong run, should investors still buy — or lock in profits?

- Wall Street Bets on a September Rate Cut — But 2 Big Risks Could Ruin the Rally.

Markets are convinced the Fed will slash rates next month after Powell’s dovish speech, but looming inflation data and labor market shifts could still derail the cut.

- Google Just Dodged a Breakup — Alphabet Stock Explodes to Record Highs After Antitrust Win. Alphabet shares surged past $229 after a judge ruled Google won’t be forced to sell Chrome, setting up a potential run toward $395 as technical charts point to more upside.

https://finance.yahoo.com/news/watch-alphabet-price-levels-stock-150115142.html

- CoreWeave Crashes 9% as Insiders Dump Millions of Shares — Do They Think It’s Overvalued?

CoreWeave stock plunged after its lockup expired, with top execs and big investors offloading over 7 million shares at a blistering pace, raising red flags about the company’s lofty valuation.

- Gold Rockets to $3,550 Record High — Can the Fed and Trump Drama Push It Even Higher?

Gold just surged 6% in a week to all-time highs as Fed rate-cut bets, political tensions, and safe-haven demand fuel a rally that could send prices soaring past $3,600.

- CrowdStrike Soars 21% in 2025 — Is This AI Cybersecurity Leader Still a Buy or Tapped Out?

CrowdStrike’s stock is crushing rivals with booming AI-driven cybersecurity demand, record subscription growth, and billion-dollar partnerships — but investors now wonder if it has more upside left.

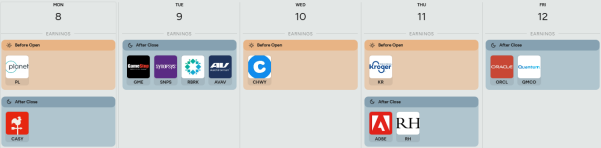

A heads-up on popular companies' earnings week from Sep 8 to Sep 12.Stay informed about when key financial updates are coming out.

Stock Analysis Report: Crowdstrike (CRWD) — September 2025

1. Durable Economic Moat

CrowdStrike holds a leading position in endpoint security with broad platform adoption and deep integrations, earning strong recognition across Gartner and IDC, while emerging tools like AI-powered threat detection build its ecosystem further.

Conclusion: CrowdStrike possesses a moderate moat, powered by platform strength and AI innovation—though not impervious to fierce cybersecurity competition.

2. Strong Financials

Q2 FY2026 highlights:

- Total revenue rose 21% to $1.17B; subscription revenue up 20% to $1.10B

- ARR increased 20% YoY to $4.66B, with net new ARR of $221M

- Record operating cash flow: $333M; free cash flow: $284M

However, GAAP face net loss of $77.7M, largely due to stock-based compensation, outage-related costs, and strategy charges

Conclusion: Financials are robust and scalable, driven by recurring revenue and strong cash flow—though GAAP results reflect near-term volatility from non-operational charges.

3. Competent Management

CEO George Kurtz led a rapid and transparent response to the major 2024 global IT outage, gaining trust despite the disruption.

Strategically, CrowdStrike is steadily expanding its platform—acquiring Onum Security, launching AI-native solutions, and achieving recognition across industry analysts.

4. Margin of Safety / Valuation

CrowdStrike stock has surged ~23% so far in 2025, reflecting optimism around AI-driven security. However, the Q3 revenue guidance was slightly below expectations, and ongoing costs from outage-related incentives are impacting near-term outlooks.

Analyst price targets remain high ($490–$500), although some have trimmed forecasts due to weaker forward guidance.

Conclusion: Valuation remains elevated with limited margin of safety—priced for strong execution, yet sensitive to delays or macro uncertainty.

Stay Ahead of the Game

What if you could be the first to uncover the latest trends, insights, and opportunities? That’s exactly what these smart investing newsletters deliver. Get exclusive access to cutting-edge updates, expert opinions, and must-know news—all in one place.

Dive into the community today, cut through the noise, and gain the edge every investor wants.

Subscribe now and get a head start on the market!

CrowdStrike is more than just another cybersecurity stock — it’s becoming the AI-native standard for protecting enterprises across the cloud and beyond. Its Falcon Flex subscription model, explosive ARR growth, and fast adoption of Next-Gen SIEM show the business is built for scale.

While the stock isn’t cheap, its leadership in AI security and recurring revenue growth make it a compelling long-term hold for investors seeking exposure to one of the most critical sectors of the digital economy.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.