Discipline vs. Distraction: What the Market’s Really Telling You.

The market is testing your discipline—don’t let it win.

Up one day, down the next. In this environment, clarity is key. We highlight the key shifts, under-the-radar signals, and stock moves that could define the weeks ahead.

- Earn Over 4% APY While You Still Can — Top Money Market Rates Are Disappearing Fast! With rates falling after Fed cuts, now’s the time to lock in a high-yield money market account before they drop even further.

https://finance.yahoo.com/personal-finance/banking/article/money-market-account-rates-today-saturday-march-15-2025-100017295.html

- Jim Rogers Reveals His Top Investment Bets! Why Silver, Oil, and Sugar Could Be Your Next Big Winners! Legendary investor Jim Rogers is doubling down on silver, agriculture, and energy—while flashing warning signs on overhyped assets.

- Cybersecurity Darling Rubrik Doubles in Value After IPO. CEO Says ‘No Slowdown in Sight. Rubrik’s CEO declares booming demand as the stock soars 25% post-earnings, defying market volatility with a $13 billion valuation surge.

https://finance.yahoo.com/news/cybersecurity-firm-rubrik-ceo-we-see-continued-strong-demand-171611801.html

- These 4 Sizzling Restaurant Stocks Are Serving Up Serious Profits—Invest Before They’re Off the Menu! From spicy wings to customizable chicken meals, these booming US restaurant chains like Yum! and Chipotle are dishing out growth, dividends, and expansion plans that investors can't afford to ignore.

- Billionaire Secrets Revealed: Timeless Investing Tips from Buffett, Ackman & Lynch You Can Actually Use. Discover the legendary wisdom of the world’s top investors and how their simple, contrarian strategies can give everyday investors a winning edge.

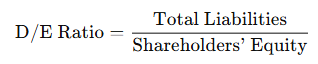

Sharpen Your Investing Skills: Understanding the Debt-to-Equity Ratio (D/E Ratio)

What Is the D/E Ratio?

- Liabilities: Includes short- and long-term debt.

- Shareholders’ Equity: What the company’s owners actually “own” after liabilities are paid.

How Investors Use It:

- Risk assessment – Higher D/E = higher interest obligations.

- Compare peers – A company with much higher D/E than its industry might be riskier.

- Used by credit analysts and long-term investors to evaluate balance sheet strength.

Example:

Total Liabilities = $200M

Shareholders' Equity = $100M

D/E = 200 / 100 = 2

The company is using $2 of debt for every $1 of equity.

Markets like this separate the reactive from the resilient. It's tempting to chase moves or panic at the dips, but real gains come from focus, not frenzy. When others flinch, your edge is discipline—seeing through the noise and acting on what truly matters.

Keep your emotions in check, your strategy close, and your eyes on the long game.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence before making any investment decisions.