FAST Keep Building Strong Returns Amid Industrial Slowdown?

Fastenal Co (FAST), a leader in industrial and construction supply distribution, continues to showcase its operational strength in a mixed economic backdrop.

As manufacturing activity cools and industrial demand moderates, Fastenal’s focus on efficiency, vendor-managed inventory, and strong customer relationships gives it an edge.

With steady dividend growth and disciplined management, investors are asking — is Fastenal still a buy at current valuations, or has the industrial cycle already peaked?

- Trump’s 10-Second Post Just Erased $2 Trillion from the Stock Market — Here’s What He Said.

A single fiery social media post from President Trump threatening massive new tariffs on China sent U.S. markets into a tailspin, wiping out $2 trillion in value in just one day.

- Costco’s Bold New Policy Sparks Member Backlash — But Investors Are Loving It! Costco’s latest perk for top-tier members has stirred controversy among shoppers, yet it’s proving a big win for management and investors as the retail giant’s adaptive strategy pays off.

- UMB Financial Just Dropped 5% — But Smart Investors See a Hidden Buying Opportunity for 2025.

After a short-term dip, UMB Financial has strong long-term gains and undervaluation score suggest this could be the perfect moment for investors to buy before the next rebound.

https://sg.finance.yahoo.com/news/does-recent-share-price-dip-080517044.html

- China’s Stock Market Just Stunned the World — Outpacing Global Rivals for the First Time in 8 Years!

Chinese stocks are roaring back with a massive 35% surge in 2025 as Beijing’s sweeping reforms, stimulus, and corporate overhauls finally ignite a market revival that’s leaving global investors scrambling to catch up.

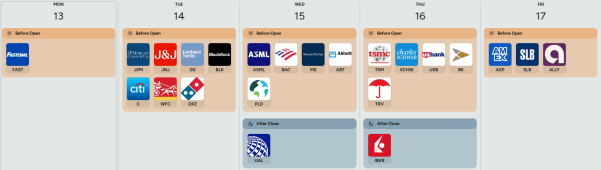

A heads-up on popular companies' earnings week from Oct 13 to Oct 17.Stay informed about when key financial updates are coming out.

Stock Analysis Report: Fastenal Co (FAST) — Oct 2025

1. Durable Economic Moat

Fastenal has built a wide and durable moat through its scale, distribution network, and integrated customer relationships.

Its vendor-managed inventory (VMI) model, on-site service capabilities, and deep penetration in manufacturing and construction markets make it extremely difficult for smaller competitors to match.

The company’s consistent service reliability and extensive product range reinforce switching costs for industrial clients.

Conclusion: Fastenal’s moat remains strong, supported by operational efficiency and sticky customer relationships that create recurring revenue.

2. Financials

Fastenal continues to post steady results despite a slower industrial economy. Revenue growth remains in the low-to-mid single digits, with stable gross margins near 45%.

Cash flow generation is robust, supporting both reinvestment and a reliable dividend policy. The balance sheet is conservative, with low debt levels and consistent free cash flow.

While the broader industrial slowdown could pressure near-term growth, Fastenal’s diversified customer base provides resilience.

Conclusion: Financial health is solid—strong cash flows and balance sheet discipline position Fastenal well through economic cycles.

3. Competent Management

Fastenal’s management has demonstrated long-term discipline in cost control, inventory efficiency, and capital allocation.

Their strategy of expanding on-site customer locations, investing in automation, and maintaining pricing discipline continues to drive incremental growth.

The leadership team’s focus on operational excellence has kept margins healthy even in weaker demand periods, reflecting an experienced and steady hand at the helm.

4. Buying at a Margin of Safety

Fastenal’s stock has historically traded at a premium due to its quality and consistency, and 2025 is no exception.

With valuations hovering above the long-term average and earnings growth moderating, the current price offers limited margin of safety for new buyers.

However, for investors seeking dividend reliability and low volatility, Fastenal remains a core holding worth accumulating on pullbacks.

Conclusion: A high-quality business with limited short-term upside—best bought during market corrections or industrial slowdown

Stay Ahead of the GameWhat if you could be the first to uncover the latest trends, insights, and opportunities? That’s exactly what these smart investing newsletters deliver. Get exclusive access to cutting-edge updates, expert opinions, and must-know news—all in one place.

Dive into the community today, cut through the noise, and gain the edge every investor wants.

Subscribe now and get a head start on the market!

Fastenal remains a steady compounder with a durable moat, thanks to its unmatched logistics network, deep customer ties, and consistent profitability.

Financially, the company maintains a strong balance sheet, robust cash flow, and one of the best dividend track records in the industrial sector. Management continues to execute well, keeping costs lean and expanding service capabilities.

For long-term investors, Fastenal is a solid hold or buy-on-dip opportunity — a dependable, high-quality business worth owning through cycles.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.