Gold Shines as Uncertainty Looms — Is SPDR Gold Trust (GLD) Still the Ultimate Safe Haven for Investors?

As a long-term value investor, I evaluate every asset through four key lenses: Durable Economic Moat, Financial Strength, Competent Management, and Buying at a Margin of Safety.

Let’s examine GLD in today’s market context and see whether it still earns a place in a balanced portfolio.

- ASML’s Secret Monopoly Could Make It the Next $1 Trillion Tech Giant — Here’s Why Investors Are Piling In!

With a near-monopoly on the machines powering the AI and chip boom, ASML’s unmatched dominance could send its stock skyrocketing over the next five years.

- Beyond Meat Just Pulled Off a 1,000% Comeback in 4 Days — Is This the Next GameStop Moment?

After years of fading demand, Beyond Meat’s stock exploded over 1,000% in just four days, fueled by meme stock mania, a Walmart deal, and a wild short squeeze that has traders asking if history is repeating itself.

- Chevron’s $53 Billion Hess Merger Could Be a Game-Changer. Why the Stock Might Be 60% Undervalued Right Now! Analysts say Chevron’s massive Hess merger and booming cash flow could make its current $155 share price a bargain, with valuation models hinting the oil giant may be trading at nearly half its true worth.

- Wall Street Just Drew a Line: Buy Nvidia, Dump Tesla — Here’s Why Analysts Are All-In on the $4.4 Trillion AI King! Top analysts are nearly unanimous—Nvidia’s AI dominance could power another 75% surge, while Tesla’s sky-high valuation is flashing red for investors.

https://finance.yahoo.com/news/nvidia-stock-vs-tesla-stock-104500212.html

A heads-up on popular companies' earnings week from Oct 27 to Oct 31.Stay informed about when key financial updates are coming out.

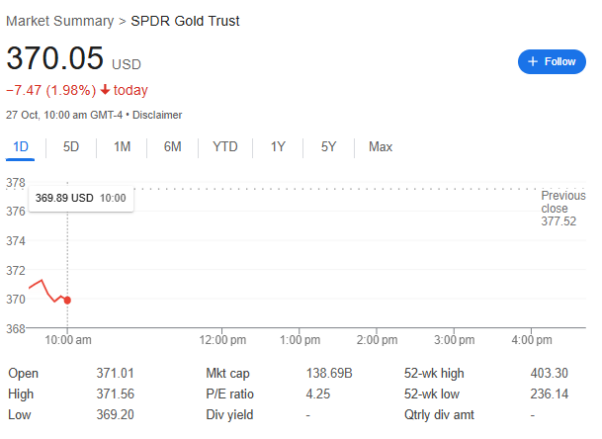

Stock Analysis Report for SPDR Gold Trust (GLD) — Oct 2025

1.Durable Economic Moat

Gold doesn’t have a “moat” in the traditional business sense, but its centuries-long role as a store of value gives it unmatched staying power. It remains a safe-haven asset when markets wobble, inflation rises, or geopolitical tensions flare.

The SPDR Gold Trust (GLD) amplifies this advantage by offering institutional-grade access to physical gold, held in secure vaults.

Conclusion: GLD’s moat lies in trust, liquidity, and accessibility, making it the go-to gold vehicle for institutional and retail investors alike.

2.Financials

Headline Numbers (as of Q3 2025):

- Assets Under Management (AUM): ~$67 billion

- Gold Holdings: ~950 tonnes

- YTD Performance: +11% (vs. S&P 500 +7%)

- Expense Ratio: 0.40%

- Inflows (YTD): +$3.2 billion

GLD tracks the spot price of gold, so its performance depends directly on global gold prices, which have climbed to $2,350/oz, a new record high amid central bank buying and persistent inflation fears. While GLD doesn’t generate “earnings,” its liquidity, tight tracking, and low tracking error continue to attract long-term investors.

Conclusion: Financially robust and highly efficient, GLD remains the benchmark ETF for gold exposure.

3.Competent Management

GLD is managed by State Street Global Advisors, one of the largest and most reputable ETF issuers globally.

Their strong operational discipline ensures accurate gold pricing and secure custody through HSBC’s London vaults. Regular audits and transparent reporting enhance investor confidence.

4.Buying at a Margin of Safety

Unlike traditional equities, GLD’s “valuation” depends on macroeconomic conditions rather than cash flows. With interest rates stabilizing and inflation still sticky, real yields remain low, supporting higher gold prices.

However, if global growth accelerates and rate cuts stall, gold could face pressure.

Conclusion: GLD is fairly valued for long-term holders seeking portfolio diversification, but new investors may prefer to accumulate gradually on pullbacks near $2,200/oz levels.

Stay Ahead of the Game

What if you could be the first to uncover the latest trends, insights, and opportunities? That’s exactly what these smart investing newsletters deliver. Get exclusive access to cutting-edge updates, expert opinions, and must-know news—all in one place.

Dive into the community today, cut through the noise, and gain the edge every investor wants. Subscribe now and get a head start on the market!

Gold remains one of the most reliable long-term wealth protectors, and GLD is still the easiest, most liquid way to own it. With central banks worldwide steadily accumulating gold reserves — particularly in Asia and emerging markets — the demand floor remains solid.

This trend reflects a shift away from U.S. dollar dependence, as nations hedge against currency volatility, geopolitical risks, and persistent inflation.

For individual investors, that’s a powerful signal: when the people who print money are buying gold, you should pay attention.

While short-term pullbacks may occur as yields fluctuate, these dips present attractive accumulation opportunities for disciplined investors looking to build long-term portfolio resilience.

Continue to accumulate GLD on dips, as global monetary diversification and central bank demand provide durable support for higher long-term gold prices.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.