Markets Are Shifting—Here’s Where Smart Money’s Headed Next.

From tariff threats shaking up tech giants to AI cloud players rewriting the rules, this week’s stories aren’t just headlines—they’re signals. We break down what matters most: surprising winners, looming risks, and opportunities you can’t afford to miss. All in 10 minutes or less. Let’s get into it.

- Trump Threatens 25% Tariff on iPhones — Is Apple the Next Trade War Casualty?

Just as markets began to recover, Trump reignites trade war fears with new threats targeting Apple and Europe, sending shockwaves through Wall Street.

- Palantir Just Landed a $1.3 Billion AI Defense Deal — Is This the Next Big Government Tech Giant? Wall Street is buzzing after Palantir secured a massive $1.3B military AI contract, with analysts calling it one of the top stocks to own in 2025.

https://sg.finance.yahoo.com/news/billion-dollar-ai-contract-wall-054609707.html

- Amazon’s Revenue Just Blew Past Expectations—Is This the Ultimate AI Stock to Buy Now? Truist just confirmed Amazon is crushing Q2 forecasts with billions in surprise revenue—and Wall Street says it could soar another 43%.

https://sg.finance.yahoo.com/news/truist-reiterates-buy-amazon-com-055217215.html

- Nvidia’s Secret Weapon? How CoreWeave Could Take Over the AI Cloud Game. Backed by billions and priority access to Nvidia’s most advanced chips, CoreWeave is gunning for dominance in the AI cloud war — and it might just outpace Big Tech.

- Why This “Low-Yield” Dividend ETF Could Make You Richer Than High-Yield Alternatives.

With only a 1.9% yield, Vanguard’s Dividend Appreciation ETF may seem underwhelming now — but its long-term dividend growth could quietly build serious retirement wealth.

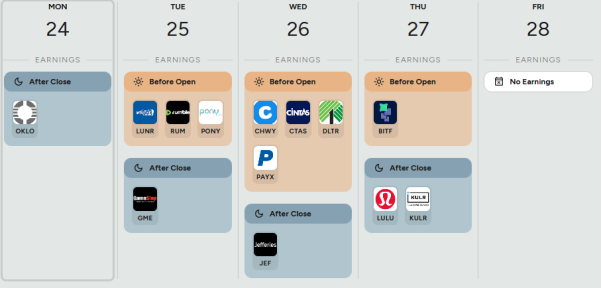

A heads-up on popular companies' earnings week from March 24 to March 28. Stay informed about when key financial updates are coming out.

Sharpen Your Investing Skills:

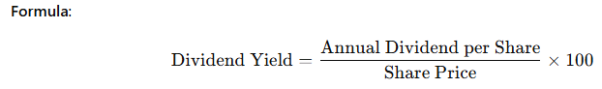

Dividend Yield – Income from Holding a Stock

What it shows: How much return investors get from dividends relative to share price.

Yield | Meaning |

High | Attractive income, but watch for sustainability. |

Low | Often growth-focused company reinvesting profits. |

- Popular with income investors and retirees.

From Trump’s tariff threats rattling Apple and Europe to Nvidia quietly building an AI cloud empire through CoreWeave, the market is bracing for volatility—yet not all opportunities come with fireworks. While headlines focus on trade wars and tech battles, long-term investors should take note of stealthy performers like Vanguard’s Dividend Appreciation ETF (VIG). It may not grab attention with flashy yields, but its steady dividend growth could quietly power your portfolio for decades.

In a world full of noise, the best moves often come from tuning into the signal.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.