Mixed Signals, Big Stakes: Navigating Today’s Market.

New highs. Sharp dips. Mixed signals. Welcome to today’s market. With volatility rising and trends turning quickly, this week’s moves could define your next win—or your next mistake. We break down what really matters right now.

- Stocks Set to Slide After Trump’s Tariff Bombshell Markets are bracing for a sharp pullback after Trump’s 90-day tariff pause sparks global rallies, while investors eye key inflation and jobless data that could shake the outlook.

- 3 Alarming Red Flags Flashing for the Economy — Is a Stock Market Crash Coming? Plunging consumer confidence, falling bond yields, and widening credit spreads are sending a chilling warning to investors about what’s next for the market.

https://www.marketwatch.com/video/need-to-know/how-to-read-3-red-flags-for-the-economy-and-what-they-mean-for-stocks/C582C5F8-D2B8-4C46-A406-BA649EF95FC3.html

- The Future in AI-Powered Stock Vanguard Sounds the Alarm: AI Stock Boom Could End in a Painful Crash! Vanguard warns that Wall Street's AI frenzy has gone too far, with stocks pricing in unrealistic expectations — and a market correction may be looming.

- Nasdaq's Red-Hot Rally at Risk? Here's What Could Shake Wall Street in 2025! After a tech-fueled surge in 2024, Wall Street faces rising bond yields, policy shifts, and a possible correction as key support levels hang in the balance heading into 2025.

- Biggest Market Crash Since 2020! Why the 2025 Rebound May Not Be So Quick. After a brutal drop, experts warn the S&P 500’s path to recovery could be slower and shakier than the pandemic rebound.

https://sg.yahoo.com/finance/news/stocks-havent-fallen-this-much-since-2020-their-recovery-could-look-different-this-time-212645541.html

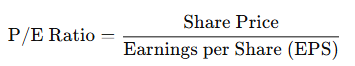

Sharpen Your Investing Skills: Understanding the P/E Ratio (Price-to-Earnings Ratio)

What Is the P/E Ratio?

Share Price: The current market price of one share of the company.

EPS: Earnings Per Share = Net Income ÷ Number of Outstanding Shares.

How Investors Use It:

- Compare to industry peers: Is the company cheaper or more expensive than others in the same sector?

- Growth vs. Value: High P/E often means growth stock; low P/E can mean value stock.

- Forward P/E: Uses projected future earnings, not past.

Example:

Company A's stock price = $100

EPS = $5

P/E = 100 / 5 = 20

This means investors are paying $20 for every $1 the company earns.

This week’s headlines are a reminder that no market moves in isolation. From global tariffs to central bank signals, every ripple can have far-reaching effects. In times like these, staying informed isn’t just smart—it’s essential. Keep your strategy flexible, your perspective long-term, and don’t forget to keep learning along the way. The more you understand, the better prepared you’ll be for whatever comes next.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your due diligence before making any investment decisions.