Nvidia Stock Plunges After Blowout Earnings — Is the AI King Finally Vulnerable?

Nvidia crushed expectations with a massive 56% revenue surge, but China sales woes and regulatory headwinds sent shares tumbling after hours. Despite its dominance in AI chips and unmatched moat, questions remain about whether the stock’s lofty valuation can withstand mounting risks.

- Warren Buffett’s Secret $1 Billion Bet Revealed — Here’s the Dividend King He Just Loaded Up On.

Berkshire Hathaway’s mystery stock picks are out, and Buffett’s team just poured over $1B into housing plays — including a Dividend King that could be a powerhouse for both income and growth investors.

- ByteDance Surges Past Meta — TikTok Owner Now Worth $330 Billion After Jaw-Dropping Revenue Boom.

TikTok parent ByteDance just hit a stunning $330B valuation as soaring ad revenue makes it the world’s top-grossing social media giant, even outpacing Facebook and Instagram owner Meta.

https://sg.finance.yahoo.com/news/exclusive-tiktok-owner-bytedance-sets-142117183.html

- This Little-Known Fintech Just Beat Visa & Mastercard — But There’s a Catch Investors Can’t Ignore. Paymentus is flashing breakout signals with a top-tier rating that outranks Visa and Mastercard, but its late-stage chart pattern makes the opportunity riskier than it looks.

- Nvidia Stock Tanks After Hours — China Trouble Wipes Out Billions Despite Blowout Earnings. Nvidia’s stellar 56% revenue jump was overshadowed by a sharp China sales slump and mounting regulatory hurdles, sending its shares plunging over 5% in after-hours trading.

https://sg.finance.yahoo.com/news/nvidia-shares-slip-hours-trading-093000766.html

- Tech Stocks Tumble as Dell Crashes 9% — Fed Rate Cut Hopes Fail to Save Wall Street.

Wall Street slid Friday with Dell’s AI cost woes sparking a tech selloff, while cooling inflation kept September Fed rate cut bets alive but couldn’t stop the Nasdaq from dropping over 1%.

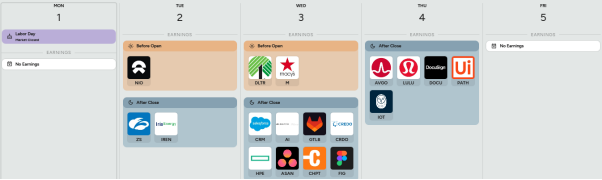

A heads-up on popular companies' earnings week from Sep 1 to Sep 5.Stay informed about when key financial updates are coming out.

Stock Analysis Report: NVIDIA Corporation (NVDA) — August 2025

1. Durable Economic Moat

NVIDIA commands an almost unassailable lead in AI hardware, controlling over 80% of the GPU market for AI, embedded through its CUDA software platform, developer ecosystem, and tight integration with data center workflows.

The Blackwell architecture furthers this advantage, driving leaps in AI training and inference performance

Conclusion: NVIDIA possesses a very wide and enduring moat, unlike nearly any other tech company.

2. Strong Financials

Q2 FY26 results: Revenue $46.7B (+56% YoY), with Data Center contributing $41.1B—highlighting massive scale in AI demand

- Margins: Non-GAAP gross margin stood at ~72.7%, reflecting durable pricing power

- Profit & Cash Returns: Net income rose 59% YoY; management returned $24.3B in capital via share buybacks in H1 FY26, and approved an additional $60B authorization

- Future Outlook: Q3 revenue guidance of $54B tops expectations, suggesting continuing strength

Conclusion: Financials are exceptionally strong and expanding, backed by consistent cash generation and shareholder returns.

4. Margin of Safety / Valuation

Valuation: NVDA trades at ~58x trailing earnings (high), but justified by PEG ratio (~0.68) and industry-leading growth

Analyst views: Morningstar raised its fair value to $190 (from $170), albeit with very high uncertainty. analysts see upside to $210 based on AI dominance

Skeptical views: Peter Thiel suggests current valuations may echo dot-com excesses; investors remain cautious amid hype concerns

Narrative: The valuation today is based heavily on future expectations—some argue it already prices in much of NVDA’s growth story

Conclusion: There is limited margin of safety—valuation is elevated and expects perfection, leaving little downside cushion for mistakes or macro shocks.

Stay Ahead of the Game

What if you could be the first to uncover the latest trends, insights, and opportunities? That’s exactly what these smart investing newsletters deliver. Get exclusive access to cutting-edge updates, expert opinions, and must-know news—all in one place.

Dive into the community today, cut through the noise, and gain the edge every investor wants.

Subscribe now and get a head start on the market!

NVIDIA has a very strong business moat in AI chips and platforms, backed by dominant market share, software ecosystem lock-in, and visionary leadership. Its financial growth remains exceptional, with soaring revenue, margins, and cash returns. However, the stock’s valuation leaves little margin of safety, making it a world-class business—but one best bought at a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.