Oracle Stock in 2025: Can OpenAI-Powered Cloud Growth Outpace Rising Risks?

Oracle (ORCL) is no longer just the old-guard database giant — it’s rapidly reinventing itself as a cloud and AI powerhouse. With its deepening ties to OpenAI and a massive $455B backlog in cloud contracts, Oracle is positioning itself as a critical player in the race for enterprise AI adoption.

But while growth is strong, the heavy cloud infrastructure build-out raises concerns around costs, execution, and competition from hyperscale rivals like Microsoft, Amazon, and Google.

1) Gold vs. Bitcoin: Both Up 28% in 2025 — But One ETF Is Breaking Records Faster Than the S&P 500!

Gold and Bitcoin are neck-and-neck with 28% gains this year, but a record-shattering surge in Bitcoin ETFs is stealing the spotlight as investors flock to alternatives for diversification.

2) Oracle Hits Record High as It Targets $144 BILLION in AI Revenue — And Half a Trillion in Backlog!

Oracle stock soared to an all-time high after unveiling a jaw-dropping $144B AI revenue forecast and a backlog nearing $500B, signaling massive growth ahead.

https://sg.finance.yahoo.com/news/oracle-corp-orcl-climbs-time-131519346.html

3) Fed to Cut Rates Despite Surging Inflation — Is a Bigger Crisis Brewing?

The Federal Reserve is set to slash rates on September 17 under political pressure, but with inflation rising and markets frothy, critics warn the move could spark a dangerous shock ahead.

4) Wall Street Can’t Resist: U.S. Investors Quietly Pour Billions Into Chinese Stocks Despite Political Tensions.

Morgan Stanley reports a dramatic surge in U.S. investor interest in Chinese equities, fueled by AI, robotics, and biotech innovation—even as political risks and Alibaba’s $3.2B fundraising weigh on the market.

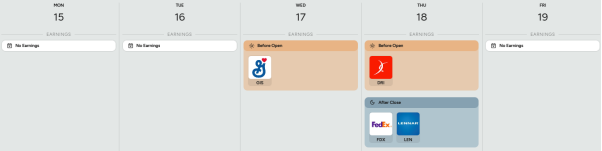

A heads-up on popular companies' earnings week from Sep 15 to Sep 19.Stay informed about when key financial updates are coming out.

Stock Analysis Report: Oracle Corporation (ORCL) — Sep 2025

1. Durable Economic Moat

- Strengths: Oracle is an established leader in database systems, enterprise software, and has been expanding strongly into cloud infrastructure (OCI) and multicloud database offerings. Its large base of legacy customers, long-term contracts, deep integration of its software and hardware stack, and high switching costs for large enterprises help sustain a strong moat. The huge backlog / remaining performance obligations (RPO) gives forward visibility.

- Risks to its moat: Competition from Amazon, Microsoft, Google, and newer AI infrastructure players is intensifying. Margin pressure from investing in cloud infrastructure may erode some of the high margins from its legacy businesses. Also, for newer offerings, Oracle is playing catch-up and scaling fast, which has both opportunity and risk.

Conclusion: Oracle has a strong, wide moat, especially in enterprise software & database infrastructure, and its cloud momentum is strengthening that moat—but it must execute well to defend margin and market share.

2. Financials

Recent performance:

- Q1 FY2026 revenue about US$14.9B, up ~12% YoY in USD (~11% in constant currency).

- Cloud (SaaS + IaaS) revenue: ~$7.2B, up ~28% YoY. OCI (IaaS) revenue up ~55%.

- Remaining Performance Obligations (RPO, aka contracted backlog) jumped to $455B, up 359% YoY.

- GAAP earnings per share slightly down (~2%), but non-GAAP EPS up (~6%).

- Operating cash flow is healthy, though capital expenditures have increased significantly.

Challenges:

- Heavy capex spending for cloud infrastructure (data centers, computing capacity) is pressuring free cash flow and margins in the near term.

- Software licence revenues are flat to slightly declining, meaning legacy segments are not growing robustly. The growth is coming mostly from cloud offerings.

Conclusion: Oracle’s financials are very solid, with strong growth in cloud revenue and impressive backlog giving forward visibility. Near-term margin pressure is real due to infrastructure investments, but the revenue growth and cash generation suggest that Oracle is on a strong financial footing.

3. Competent Management

- Vision & Execution: Oracle’s leadership (CEO Safra Catz, Larry Ellison, etc.) has been firm in pushing aggressively into cloud infrastructure and AI workloads, winning large contracts. The disclosures about multiyear forecasts (e.g. OCI revenue expected to grow heavily over the next several years) reflect confidence and strategic clarity.

- Operational risk handled: Oracle seems to be balancing legacy product lines while moving into more capital-intensive cloud infrastructure. The size of its contract backlog (RPO) suggests discipline in getting long-term deals locked in, which supports predictability.

- Risks / concerns: Scaling data centers is capex-intensive and subject to supply constraints and cost inflation. Also, competition is strong, and execution in cloud is not trivial: latency, performance, and costs matter. Free cash flow could be negative during heavy investment phases. Management will need to ensure that long-term returns are worth the upfront cost.

4. Margin of Safety / Valuation

Positives: Oracle’s priced in high expectations, but much of its future cloud infrastructure revenue is already backed by contracts (RPO), which reduces some uncertainty. The growing recognition by analysts (e.g. Jefferies raising price targets) suggests market is buying into the growth story.

Negatives:

- The stock rally is strong, so much upside might already be baked in. Margin pressures from capex will reduce near-term free cash flow.

- Non-cloud legacy businesses are not growing as fast or may be declining, meaning future growth depends heavily on cloud/AI performance.

- Investors must assume that Oracle will continue to capture large contracts and scale infrastructure efficiently without blowing up costs.

Valuation: Given the strong growth in RPO and cloud revenue, the valuation seems justifiable for many growth investors—but for a value investor looking for margin of safety, the risk is that a slip in growth or cost overruns could lead to overreaction.

Conclusion: Margin of safety is moderate to thin, not generous. The thesis is strong but needs Oracle to deliver.

Stay Ahead of the Game

What if you could be the first to uncover the latest trends, insights, and opportunities? That’s exactly what these smart investing newsletters deliver. Get exclusive access to cutting-edge updates, expert opinions, and must-know news—all in one place.

Dive into the community today, cut through the noise, and gain the edge every investor wants.

Subscribe now and get a head start on the market!

Oracle’s moat in enterprise software and its aggressive cloud/AI push give it a powerful long-term growth story, especially as OpenAI partnerships fuel demand for its infrastructure.

However, the stock is priced for strong execution, leaving limited margin of safety. Investors should recognize Oracle as a cautious buy — attractive for its scale and AI exposure, but with risks around capex, margins, and whether it can sustain momentum against larger cloud rivals.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.