Outsmart the Market: Signals You Can’t Ignore

Markets move fast, but smart investors move first.

This week, we are diving into the hidden influence of corporate buybacks, signals that could mean trouble ahead, and stocks that took a beating—are they done, or ready to rebound?

- Market Comeback! Dow Soars 600+ Points as Nasdaq Has Best Day Since November! After a wild week of volatility, U.S. stocks roared back Friday with the Dow surging 600+ points and the Nasdaq posting its biggest gain in months—here’s what fueled the dramatic rebound!

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-jump-as-stocks-head-for-steep-weekly-losses-133049844.html

- Oil Price Shock: Barclays Slashes 2025 Forecast—Here’s Why Crude Could Drop Further! Barclays just cut its 2025 Brent oil price forecast by $9, citing weak demand and economic uncertainty—could this signal even lower prices ahead?

https://www.reuters.com/business/energy/barclays-cuts-2025-brent-oil-price-forecast-soft-demand-view-2025-03-14/

- These 3 AI Stocks Could Skyrocket Up to 167%—Wall Street’s Boldest Predictions Yet! Wall Street analysts are betting big on AI, predicting that three scorching-hot stocks—led by Nvidia—could soar as much as 167% in the next year!

- 20 Hidden Gem Stocks Poised for Massive Gains—Are You Missing Out? These 20 S&P 500 stocks are trading at bargain prices—find out which undervalued gems could be your next big investment win!

https://www.nerdwallet.com/article/investing/undervalued-stocks?ajs_uid=d226f64f6d3cbd2bc04d1dd94272b3ba0a83e492a9d75a340a39dca807122524

- Beginner's Guide to Stock Investing in 2025—7 Simple Steps to Build Wealth! Want to start investing but don’t know how? Follow these 7 easy steps to grow your wealth and navigate the stock market like a pro!

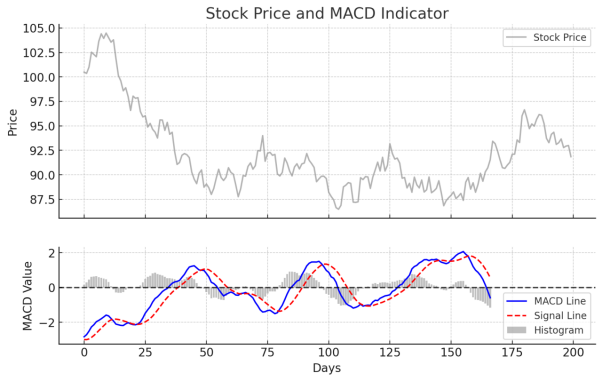

Sharpen Your Investing Skills: Understanding the Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that helps traders identify changes in stock price trends and momentum. It is based on the relationship between two moving averages.

Why is MACD Important?

- Identifies Trend Direction – Helps traders see when momentum is shifting.

- Generates Buy & Sell Signals – MACD crossovers indicate potential entry and exit points.

- Measures Momentum Strength – A rising MACD shows strong momentum, while a falling MACD signals weakening momentum.

MACD Trading Signals

- Bullish Crossover – MACD Line crosses above the Signal Line → Potential Buy Signal.

- Bearish Crossover – MACD Line crosses below the Signal Line → Potential Sell Signal.

- Divergence – If price moves in one direction but MACD moves in the opposite direction, it may indicate a trend reversal.

Here’s a chart showing how the MACD Indicator moves with stock prices. The MACD Line (blue) and Signal Line (red, dashed) generate buy and sell signals when they cross. The Histogram (gray bars) represents the strength of momentum. When the histogram turns positive, it suggests bullish momentum; when negative, it signals bearish momentum.

The stock market is always shifting—but behind every move is a pattern, a signal, or an opportunity.

The key is staying informed, disciplined, and focused on the bigger picture. Whether you're riding a breakout or waiting out a pullback, remember: long-term success comes from preparation, not prediction.

Stay sharp, stay patient, and let your strategy guide you.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your due diligence before making any investment decisions.