Sentiment Shaken, But Still Standing: What Investors Are Telling the Market.

Investor Sentiment Shaken, Not Stirred. Despite heightened anxiety over market sell-offs and policy uncertainties, many investors are holding their positions.

We delve into the psychology behind this resilience and what it suggests for market dynamics moving forward.

- Nvidia Crushed, Fed Shaken, Trump Tariffs Loom: Why the Stock Market Just Took a Nosedive. A wild week on Wall Street saw Nvidia slammed by export bans, Powell warning of economic turmoil, and Trump tariffs rattling markets—here’s what it all means for your money.

- Netflix Shocks Wall Street With Blowout Earnings — While Tech Giants Stumble! Netflix crushed Q1 expectations with soaring profits and bullish guidance, proving it’s the rare Big Tech winner in 2025’s rocky market.

https://sg.finance.yahoo.com/news/netflix-earnings-wall-street-high-on-stock-as-defensive-choice-while-big-tech-reels-from-trumps-tariffs-191541276.html

- AI Chip Boom Sends Taiwan Semiconductor Soaring — But Is Trouble Looming? TSMC crushed Q1 earnings on surging AI demand and issued bullish Q2 guidance, but analysts warn of storm clouds ahead for the chip giant.

- Top 10 Stock Picks for 2025 That Could Crush the Market — Even If the Economy Doesn’t! From AI-driven distributors to insurance giants defying market chaos, these expert-backed stocks are set to thrive amid 2025’s economic uncertainty.

https://money.usnews.com/investing/articles/best-stocks-to-buy-this-year

- Markets on Edge: Will Tariffs, Jobs Data, and Fed Uncertainty Spark the Next Big Sell-Off? As the trade war kicks in and payroll data looms, investors face a high-stakes week that could reshape Fed policy and rattle markets further.

A heads-up on companies earnings week and stay informed about when key financial updates are coming out.

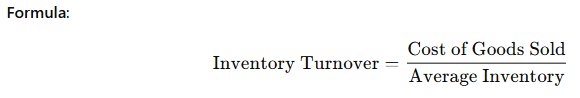

Sharpen Your Investing Skills: Inventory Turnover Ratio – Efficiency in Managing Inventory

What it shows: How quickly a company sells its inventory.

Turnover | Meaning |

High | Efficient sales or low inventory levels. |

Low | Weak sales or overstocking. |

- Especially important for retail or manufacturing businesses.

Markets may wobble, headlines may spark fear, but this time—investors aren’t running. That says something powerful. Whether it’s conviction, experience, or sheer patience, resilience in sentiment can shape market direction just as much as any data point.

The key? Don’t just watch what investors say—watch what they do. In moments of uncertainty, actions reveal the real sentiment. And if you’re thinking long-term, steady hands still hold the advantage.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence before making any investment decisions.