Sharp Swings, Clear Moves: Making Sense of Market Volatility.

The headlines are loud—but the real signals are quieter.

Inflation fears, interest rate chatter, and sector shakeups are reshaping the market. Here’s what’s noise, what’s real, and what could move your portfolio next.

- Tech Stocks Explode! Nvidia and Palantir Lead Massive Rally. Markets just posted their best day of 2025—despite a brutal 4-week losing streak and growing fears over Trump’s tariff-fueled inflation surge.

- Industrial Boom or Bust? Standex Just Posted Record Margins—But the Sector's in Trouble. Standex defied the trend with record sales and margins, even as gas and liquid handling stocks slump 11% amid a tough Q4 earnings season.

https://finance.yahoo.com/news/reflecting-gas-liquid-handling-stocks-091036170.html

- China's Bold Crackdown on AI-Driven Fake News: A Ticking Time Bomb for Stock Markets? China vows to tackle the growing threat of AI-powered misinformation in the stock market, warning of severe actions against those spreading fake news that could manipulate investors.

https://finance.yahoo.com/news/china-crack-down-stock-market-105825064.html

- Google’s $32B Cybersecurity Bet: A Bold Move or Desperate Gamble?Alphabet’s $32 billion acquisition of cybersecurity firm Wiz raises questions about Google’s competitive future, cloud computing growth, and whether it can outpace rivals like Amazon and Microsoft.

- Top 11 Low-Risk Investments That Could Safely Boost Your Portfolio in 2025! Discover the safest, high-liquidity investments for 2025 that offer stability and modest returns, perfect for weathering uncertainty in a higher-rate environment.

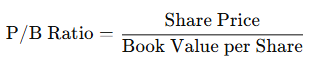

Sharpen Your Investing Skills: Understanding the Price-to-Book Ratio (P/B Ratio)

What Is the P/B Ratio?

- Book Value: The company’s total assets minus its liabilities (i.e., what the company is actually worth on paper).

- Book Value per Share = Total Book Value / Number of Outstanding Shares

How Investors Use It:

- Compare with industry average – A bank with a P/B of 0.8 might be cheap if peers average 1.5.

- Spot deep value stocks – Especially if a company has solid fundamentals but a low P/B.

- Works best for companies with tangible assets (less useful for tech or IP-heavy firms).

Example:

Share Price = $50

Book Value per Share = $25

P/B = 50 / 25 = 2

Investors are paying $2 for every $1 of the company’s net assets.

In a market defined by sharp swings and shifting signals, staying grounded is your greatest edge. It’s easy to get caught up in the noise—but long-term success comes from filtering out distractions, recognizing real trends, and making decisions with clarity and discipline.

Volatility creates risk—but also opportunity. Stay focused, stay flexible, and let the data guide you, not the headlines.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your due diligence before making any investment decisions.