Social Security Shake-Up, AI Alliances & Dividend Giants.

Markets are on the move this week—with Social Security hikes on the horizon, inflation finally cooling, and a surprise U.S.-China trade deal shaking up stocks.

Add in a shocking AI alliance between OpenAI and Google, plus high-yield opportunities in Dow dividend giants, and investors have plenty to digest. Here's what you need to know to stay ahead.

- These 3 Dow Stocks Are Paying Massive Dividends — Should You Buy In Before Everyone Else Does?

Verizon, Chevron, and Merck are dishing out the highest dividend yields in the Dow—here's why investors are eyeing them as income goldmines.

- OpenAI Just Partnered With Google — The AI War Just Got Way More Complicated. Despite being rivals in AI and search, OpenAI is teaming up with Google Cloud for data center power—proof that even the fiercest competitors need each other to scale.

- Stocks Jump as Inflation Cools and U.S.-China Strike Surprise Trade Deal—Tesla, Quantum Stocks Lead Rally.

Markets climbed after soft inflation data and a breakthrough U.S.-China trade deal, with Tesla and quantum computing stocks surging as investors bet on rate cuts and tech cooperation.

- Social Security Checks Set to Rise in 2026—But a Surprise Tariff Twist Could Change Everything.

A 2.5% boost is expected for 2026 Social Security benefits, but looming tariffs and inflation could shake up the final increase before it's officially announced in October.

https://www.marketwatch.com/story/your-social-security-check-could-rise-2-5-in-2026-but-inflation-and-tariffs-are-still-in-question-70ad9458?mod=newsviewer_click

- Markets Panic as Israel Strikes Iran—Oil Prices Soar, Stocks Plunge, and Gold Nears Record High!

A sudden Israeli attack on Iran triggered missile retaliation, sending global stocks tumbling, oil prices skyrocketing over 13%, and investors scrambling for safe havens like gold and the U.S. dollar.

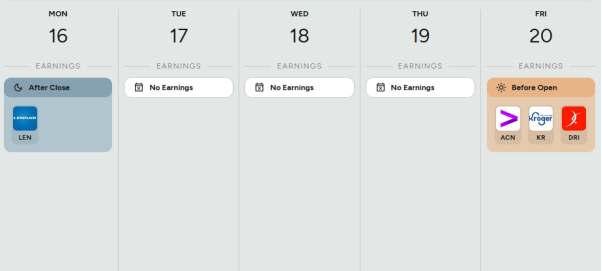

A heads-up on popular companies' earnings week from June 16 to June 20. Stay informed about when key financial updates are coming out.

Sharpen Your Investing Skills: Understanding and Using Support & Resistance Levels

What Are Support and Resistance?

- Support is a price level where a stock tends to stop falling because demand (buying interest) increases.

- Resistance is a level where a stock tends to stop rising due to increased selling pressure.

These are psychological and technical zones that traders and investors watch closely.

Why It Matters

Understanding support and resistance helps investors:

✅ Identify entry and exit points

✅ Place stop-loss or profit-taking levels

✅ Recognize trend reversals or breakouts

✅ Improve risk management

How to Use It:

Scenario | Strategy |

Stock approaches support | Look for bounce → potential buy opportunity |

Stock nears resistance | Watch for rejection → possible sell/short |

Breaks above resistance | May signal bullish breakout |

Falls below support | May signal bearish breakdown |

From surprise trade deals and inflation dips to unexpected AI partnerships and rising retirement payouts, this week proves one thing: the market never stays quiet for long. Whether you're chasing growth or securing income, staying nimble is your edge.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.