Steady in the Storm: What Smart Investors Need to Know.

Choppy waters ahead—steady hands required. With markets reacting to every headline, staying grounded is key.

This week, we cut through the noise to bring you the insights that matter, in just 10 minutes.

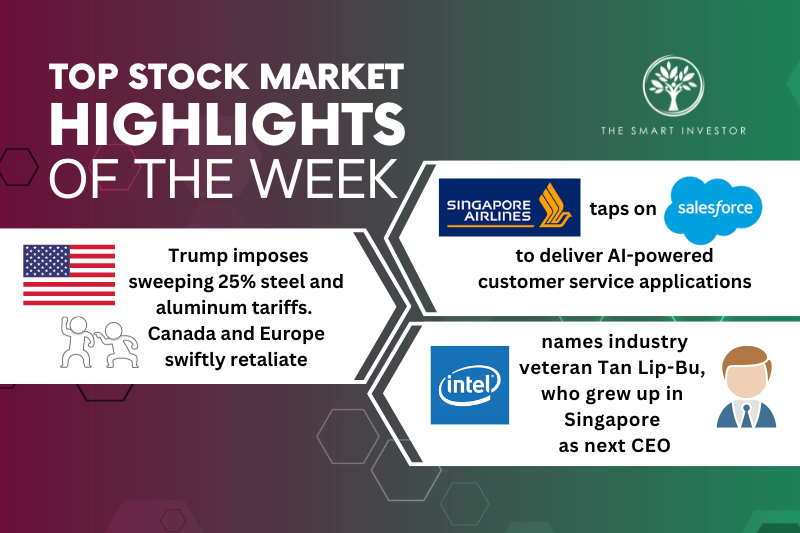

- Singapore Airlines Partners with Salesforce for AI Revolution, Trump’s Tariffs Shake Markets, and Intel Gets a New CEO—What You Need to Know! From Salesforce’s AI collaboration with Singapore Airlines to Trump's latest tariff threats and Intel’s new CEO, this week’s stock market highlights have investors on edge—find out what’s moving the market now!

- Powell Outshines Peers in Q4 Earnings: But Will the Electrical Systems Sector Bounce Back? Powell beats Q4 revenue estimates with impressive growth, but can the electrical systems industry recover from a rough quarter marked by economic headwinds and missed forecasts?

https://finance.yahoo.com/news/q4-earnings-highs-lows-powell-090923785.html

- 3 Must-Buy AI Stocks to Grab During the Market Dip – Big Gains Ahead! Don’t miss the chance to invest in top AI stocks while they’re down – these picks are primed for massive growth over the next 3 to 5 years!

https://www.nasdaq.com/articles/3-artificial-intelligence-ai-stocks-buy-during-stock-market-downturn

- 3 Powerful Reasons Dividend Stocks Are Your Secret Weapon Against Market Chaos. Discover how dividend stocks can provide steady returns, shield you from market downturns, and boost your cash flow even during financial turbulence.

- Warren Buffett’s Top 2 Investing Rules That Could Make You Rich. Learn the simple yet powerful investing principles Warren Buffett swears by to protect your wealth and achieve long-term success in the stock market

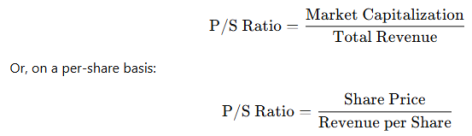

Sharpen Your Investing Skills: Understanding the Price-to-Sales Ratio (P/S Ratio)

What Is the P/S Ratio?

How Investors Use It:

- Growth Stocks: Often used to value companies that are reinvesting profits and not yet profitable.

- Compare peers: A tech company with a P/S of 5 might still be cheap compared to others at 10.

- Check profitability: Combine P/S with margin analysis for deeper insights

Example:

Share Price = $20

Revenue per Share = $10

P/S = 20 / 10 = 2

Investors are paying $2 for every $1 of the company’s revenue.

In a market swayed by headlines and emotion, your best move is to stay focused, not frantic. Trends may shift, but your edge comes from understanding what truly drives them—not just reacting to the noise.

Take a breath, tune out the panic, and stick to the process. Smart investing isn’t about chasing every move—it’s about showing up with a clear head, every time.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence before making any investment decisions.