Storm Watch: How to Invest When Markets Get Rough.

Markets in Turmoil: Navigating the Storm U.S. stocks are experiencing significant volatility as aggressive tariffs and escalating trade tensions unsettle investors. This week, we dissect the factors driving the market's turbulence and provide insights to help you steer your investments through these choppy waters.

- Markets Soar as Shutdown Averted — Ulta, Docusign, and Rubrik Skyrocket on Surprise Wins! Stocks surged midday as government shutdown fears eased, while Ulta Beauty, Docusign, and Rubrik stunned Wall Street with blowout results.

- Warren Buffett’s Favorite Strategy: How “Economic Moats” Make Companies Untouchable. Discover how top companies build unbreakable defenses against competition—and how you can spot them before they dominate the market.

- Intel Just Hired a New CEO—Here’s Why the Stock Is Surging (But Trouble Still Looms). Wall Street cheered Intel’s surprise CEO pick, but the chip giant’s deeper problems may still threaten a lasting comeback.

- Docusign Stock Skyrockets After AI Breakthrough—Is This the Start of a Massive Comeback? Docusign crushed earnings expectations and saw shares surge nearly 20% as its new AI-powered platform gains explosive traction with customers.

- Is a High P/E Ratio a Red Flag—or a Hidden Goldmine? What Every Investor Needs to Know. Understanding the P/E ratio can make or break your investing decisions—learn why this simple number is more complex (and powerful) than it seems.

A heads-up on companies earnings week and stay informed about when key financial updates are coming out.

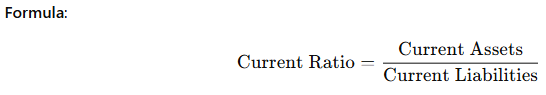

Sharpen Your Investing Skills: Current Ratio – Liquidity Check

What it shows: A company’s ability to pay short-term obligations.

Ratio Value | Meaning |

> 1 | Can cover short-term debts (healthy). |

< 1 | Might struggle to meet short-term liabilities. |

When markets get stormy, fear rises—and so do opportunities for those who stay level-headed. Trade tensions and tariff talk can trigger sharp moves, but smart investors know that chaos often reveals mispricing, not just risk.

The key? Don't react blindly. Understand the forces at play, tighten your strategy, and remember: storms pass—but disciplined investors come out stronger.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence before making any investment decisions.