Tech Titans Tumble: What Trade Tensions Mean for Your Portfolio.

Tech Titans Tumble Amid Trade Turmoil

The tech sector is under pressure as companies like Nvidia and Tesla face challenges stemming from new export restrictions and tariff uncertainties.

We explore how these developments are impacting the broader market and what it means for tech investors.

- Nvidia Tanks, Tesla Slips, Google Stumbles—Is the Magnificent Seven's Reign Over? Once market darlings, these tech titans are now dragging down indexes as Nvidia faces a $5.5B hit and the Magnificent Seven stumble into 2025.

- Market Mayhem: Dow Futures Rebound After Trump Tariff Shock. As Trump’s wild tariff threats and annexation talk slam the S&P 500 to new lows, Warren Buffett’s Berkshire quietly enters a buy zone, signaling a surprising market twist.

- Can Nvidia’s Big AI Reveal Save Its Slumping Stock? All Eyes on CEO’s High-Stakes Keynote. With Nvidia stock down nearly 10% in 2025, investors are betting Jensen Huang’s AI conference unveilings—like the rumored GB300 chip—can reignite its market dominance.

- 5 Hidden Dividend Gems in Singapore That Could Join the STI in 2025 — Are You Holding One? These under-the-radar stocks are not only paying solid dividends but are also one step away from becoming Singapore’s next blue-chip superstars.

- The Dow Jones Explained: Why It’s Your Key to Understanding the Stock Market. Unlock the secrets of the Dow Jones Industrial Average and how it impacts the stock market — and your investments — with this simple guide.

A heads-up on companies earnings week and stay informed about when key financial updates are coming out.

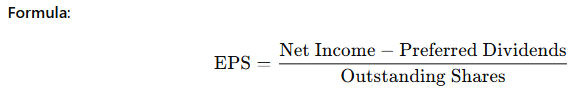

Sharpen Your Investing Skills: Earnings Per Share (EPS) – Profitability Per Share

What it shows: How much profit is attributed to each share of stock.

- Higher EPS = more profitable company = more value for shareholders.

The pressure on tech is real—and it’s more than just headlines. As trade policies tighten and export restrictions bite, even the strongest names are feeling the squeeze. But volatility doesn’t just test confidence—it creates opportunity.

For tech investors, this is a time to reassess, not retreat. Focus on fundamentals, watch the macro signals, and be ready to strike when fear creates mispriced value.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence before making any investment decisions.