The AI Race Heats Up: Surge AI Seeks $1B, Robinhood Goes Crypto, and Huawei Bets Big.

From billion-dollar AI bets to tokenized stocks and stablecoin surges, this week’s headlines prove the tech and finance world isn’t slowing down.

Surge AI is gunning for a $15B+ valuation to outpace Scale AI, Robinhood’s crypto ambitions just got real with tokenized U.S. stock trading, and Huawei is reshaping China’s AI strategy—open-source style. Meanwhile, Circle’s IPO frenzy has Wall Street buzzing as stablecoins inch closer to the financial mainstream.

- 10 Beaten-Down S&P 500 Dividend Giants to Snag Now—Before the Market Wakes Up.

These 10 high-quality dividend stocks are down over 10% but packed with long-term potential, making them rare buying opportunities in today’s rebounding market.

- Circle Stock Soars Nearly 500% After IPO—But Can Stablecoins Really Shake Up Wall Street?

As Circle’s stock explodes post-IPO, analysts debate the future of stablecoins like USDC and their growing influence on global finance and U.S. Treasury demand.

- Huawei Just Open-Sourced Its AI—And It’s Coming for Nvidia’s Crown. In a bold move to outmaneuver U.S. sanctions and dominate the global AI race, Huawei open-sourced its powerful Pangu models to boost adoption, drive hardware sales, and rival Western tech giants.

- Robinhood Just Blew Up Wall Street with Tokenized Stocks—KeyBanc Doubles Price Target!

Robinhood’s bold leap into 24/5 tokenized stock trading has analysts racing to upgrade the stock, with KeyBanc boosting its price target by a jaw-dropping 83% as the platform eyes global crypto dominance.

- Scale Who? Surge AI Seeks $1 Billion Raise After Crushing Rival in Revenue and Talent War!

Profitable and bootstrapped Surge AI is gunning for a $15B+ valuation as it races to raise $1B, outshining Scale AI in revenue and capitalizing on Meta’s CEO poach in the battle for AI dominance.

Feeling overwhelmed by too many stock choices and market noise? You’re not the only one with endless headlines, hot takes, and hype, it’s easy to feel stuck or second-guess your next move.

That’s where a smart investing newsletter makes all the difference. Instead of wasting time chasing tips or trying to make sense of market chatter, you’ll get straight-to-the-point insights on promising stocks, ETFs, and key trends — all in a clear, no-BS format you can use. No jargon. No fluff. Just curated ideas to help you invest smarter, faster, and with more confidence.

Stay ahead of the market, save hours of research, and grow your portfolio with clarity.

Check them out here — and start making informed moves in minutes.

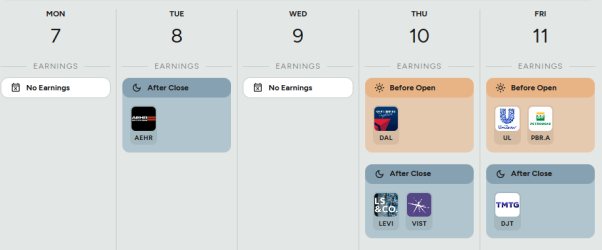

A heads-up on popular companies' earnings week from July 7 to July 11. Stay informed about when key financial updates are coming out.

Sharpen Your Investing Skills: Volume Indicator: Measuring Market Strength

What Is Volume in Trading?

Volume represents the total number of shares traded during a specific time period (like a day, hour, or minute).

Every time a buyer and a seller make a trade, it adds to the volume count

Why Volume Matters to Investors?

Volume tells you how strong or weak a price move is.

- A price increase with high volume = strong bullish conviction

- A price increase with low volume = weak, possibly short-lived

- A drop on high volume = serious selling pressure

- A drop on low volume = possibly just profit-taking, not panic

How Investors Use Volume:

Strategy | How Volume Helps |

Confirm breakouts | High volume confirms real breakouts above resistance |

Spot reversals | Volume spikes can signal trend exhaustion or reversal |

Detect fake moves | If price breaks out but volume stays low → watch out! |

Track accumulation/distribution | Gradual increase in volume = smart money possibly buying in |

Popular Volume-Based Indicators:

| Indicator | What It Does |

|---|---|

| On-Balance Volume (OBV) | Tracks cumulative volume to detect hidden buying/selling |

| Volume Moving Average | Compares current volume to historical average |

| Chaikin Money Flow (CMF) | Combines price and volume to spot accumulation/distribution |

The future of investing is being rewritten in real time. Whether it’s AI infrastructure, crypto innovation, or financial decentralization, the winners will be those who adapt early. Keep your eyes on the bold disruptors. They’re not just changing the game, they’re creating new ones.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.