Volatility Strikes—Here’s Where to Look for Strength.

Market Volatility: A Test of Strategy and Nerves

With the Dow Jones Industrial Average experiencing significant swings, including a recent 700-point drop , investors are grappling with uncertainty.

We provide a strategic overview of the current market landscape, highlighting sectors that may offer stability and growth opportunities amidst the volatility.

- AI Stocks Hit a 'Show Me' Moment: Can Tech Giants Keep Up With China's DeepSeek? The battle for AI dominance intensifies as top stocks like Nvidia and Microsoft face fierce competition, a looming trade war, and new challenges from China's DeepSeek, raising questions about the future of the AI boom.

- Is Universal Electronics Stock a Hidden Gem or a Risky Gamble? Here's What You Need to Know! With Universal Electronics trading far below its intrinsic value, investors might find an opportunity to buy low—if they can stomach the volatility that could send the price even lower.

https://sg.finance.yahoo.com/news/does-universal-electronics-inc-nasdaq-132114673.html

- AI Stocks Face Crucial Test: Will Tariffs and Competition Crush the Boom? With fierce competition, looming tariffs, and high expectations, the future of top AI stocks like Nvidia and Microsoft hangs in the balance—investors must decide if the hype will deliver.

- Louis Navellier’s Latest Pick: Is Lam Research the Hidden Gem You’ve Been Waiting For? Louis Navellier’s new stock picks include Lam Research—find out how this top investment stands out among his other selections and why it could be the next big opportunity.

https://sg.finance.yahoo.com/news/lam-research-corporation-lrcx-among-131136710.html

- Tariff Tensions Trigger Quiet Ports and Market Uncertainty: What’s Next for Stocks like Netflix and Goldman Sachs? As the trade war deepens, U.S. ports face a dramatic slowdown, while investors keep a close eye on earnings from Netflix and Goldman Sachs amidst growing market volatility.

A heads-up on companies earnings week and stay informed about when key financial updates are coming out.

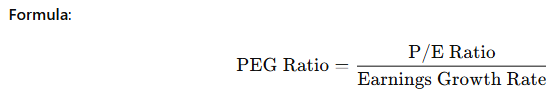

Sharpen Your Investing Skills: PEG Ratio – Growth-Adjusted Valuation

What it shows: Whether a stock’s price is justified by its growth.

PEG | Meaning |

< 1 | Potentially undervalued (growth not fully priced in). |

> 1 | May be overvalued compared to growth rate. |

- Better than P/E alone for evaluating fast-growing companies.

Market volatility isn’t just noise—it’s a stress test for your strategy. While the headlines focus on point drops, smart investors are scanning for opportunity beneath the surface. Some sectors may flinch, but others offer resilience and even upside in uncertain times.

This is where discipline meets insight. Stay focused, stay nimble, and remember: in every shakeout, there’s a setup for what comes next.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own due diligence before making any investment decisions.