War Worries, Kroger’s Bold Moves, and a Billion-Dollar Battle in Consumer Staples.

Geopolitics, earnings, and sector shakeups are driving the market’s mood this week. Trump’s pending war decision has Wall Street on edge, while Kroger rallies on store cuts and an aggressive new strategy. Meanwhile, giants like Walmart, Costco, and P&G are tightening their grip on the consumer staples space. Here's your quick, high-impact breakdown of what it all means—and where investors may find opportunity or risk ahead.

- Trump Teeters on War Decision—Markets Jitter as Wall Street Holds Its Breath. Stocks swung wildly as President Trump’s looming call on U.S. involvement in the Iran-Israel conflict keeps investors on edge, with inflation fears and Fed rate cut chatter adding fuel to the uncertainty.

https://www.reuters.com/business/wall-st-futures-edge-lower-middle-east-war-enters-second-week-2025-06-20/

- Walmart, Costco, and P&G Dominate the Essentials Game—See Who’s Winning the $Trillion Consumer Staples War. Walmart holds the crown as the largest consumer staples company in June 2025, while Costco and Procter & Gamble trail close behind with powerhouse business models and global brand empires.

- Kroger Stock Soars as It Closes 60 Stores—But There's a Surprising Twist Behind the Surge. Kroger beats earnings, raises its 2025 outlook, and plans to shutter 60 stores to boost efficiency—while still struggling to turn a profit in its booming e-commerce business.

- Marvell Stock Soars After AI Reveal—Is This the Next Nvidia in Disguise?

After a surprise AI event showcasing new clients and a $94B market opportunity, Marvell stock surged as analysts predict it could finally break out and rival top AI chipmakers.

- Cathie Wood Snaps Up Nvidia, DoorDash, and a Beaten-Down SPAC—Is a Major Comeback Brewing?

ARK Invest’s Cathie Wood just doubled down on AI titan Nvidia, delivery giant DoorDash, and the struggling yet cash-rich Nextdoor—betting big that these high-risk, high-reward plays are ready to soar.

Feeling overwhelmed by too many stock choices and market noise? You’re not the only one with endless headlines, hot takes, and hype, it’s easy to feel stuck or second-guess your next move.

That’s where a smart investing newsletter makes all the difference. Instead of wasting time chasing tips or trying to make sense of market chatter, you’ll get straight-to-the-point insights on promising stocks, ETFs, and key trends — all in a clear, no-BS format you can use. No jargon. No fluff. Just curated ideas to help you invest smarter, faster, and with more confidence.

Stay ahead of the market, save hours of research, and grow your portfolio with clarity.

Subscribe now to Investorin10 — and start making informed moves in minutes.

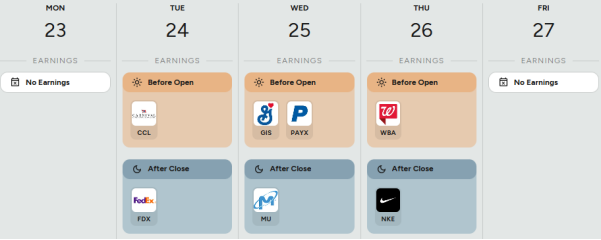

A heads-up on popular companies' earnings week from June 23 to June 27. Stay informed about when key financial updates are coming out.

Sharpen Your Investing Skills: Volume Analysis – Reading Market Strength

What Is Volume in Trading ?

Volume is the number of shares (or contracts) traded in a stock during a specific period. It's one of the most powerful confirming indicators in technical analysis.

Why Volume Matters ?

Volume helps investors understand:

- Market conviction behind price moves

- Breakout or breakdown confirmation

- Potential reversals or fakeouts

- Supply and demand dynamics

Key Concepts in Volume Analysis:

Volume Pattern | What It Suggests |

�� High volume + price ↑ | Strong bullish move (buyers in control) |

�� High volume + price ↓ | Strong bearish move (sellers in control) |

�� Price ↑ but volume ↓ | Weak rally (possible reversal) |

�� Volume spike at sideways zone | Potential breakout or fakeout ahead |

Tools to Use with Volume:

- Volume bars (on every chart by default)

- Volume Moving Average (VMA) – helps spot volume spikes

- Volume Oscillators – like On-Balance Volume (OBV), Chaikin Money Flow (CMF)

From battlefield headlines to boardroom pivots, this week’s news shows how fast narratives—and markets—can shift. Whether it’s Kroger betting on efficiency, AI transforming strategy decks, or defensive staples gaining momentum, smart investors stay alert, agile, and informed.

Stay ahead of the market, save hours of research, and grow your portfolio with clarity. Subscribe now to Investorin10 — and start making informed moves in minutes.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Please do your own due diligence before making any investment decisions.